st louis county personal property tax receipt

How do I get a St Louis County personal property tax waiver. For a pamphlet with information on Small Claims Court call 314-615-2601 or 314-615-2592.

Look For Property Tax Bills In Mail You Can Avoid Lines By Paying Online St Louis Call Newspapers

October 15th - 2nd Half Real Estate and Personal Property Taxes are due.

. Assessments are due March 1. Monday - Friday 800am - 500pm. 1200 Market Street City Hall Room 109.

On May 20 1809 Daniel Bissell took command of Fort Belle Fontaine the first military fort west of the Mississippi River. If you do not receive a form by mid-February please contact Personal Property at. To declare your personal property declare online by April 1st or download the printable forms.

You may file a Small Claims case in the St. Property 3 days ago Account Number or Address. E-File Your 2022 Personal Property Assessment.

Contact the Collector - Real Estate Tax Department. Send your payments to. Louis real estate tax payment history print a tax receipt andor proceed to payment.

Louis County Courthouse 100. Property Tax Receipts are obtained from the county Collector or City Collector if you live in St. If you have any questions you can contact the Collector of Revenue by calling 314 622-4105 or emailing propertytaxdeptstlouis-mogov.

Payments postmarked after December 31 will be returned. Payments can be made in person at 1200 Market Street Room 109. Enter Name Search Risk Free.

To declare your personal property declare online by April 1st or download the printable forms. You may pay at our office located at 729 Maple Street Hillsboro MO 63050 online at Jefferson County Property Taxes or by Interactive Voice Response by calling 877-690-3729 if paying by IVR you will need to know your bill number. Searching Up-To-Date Property Records By City Just Got Easier.

You may also pay your taxes by mail. If you did not file a Personal Property Declaration with your local assessor. You moved to Missouri from out-of-state.

Personal Property Tax Lookup And Print Receipt - St. Obtain a Tax Waiver Statement of Non-Assessment Residents with no personal property tax assessed in the prior year can obtain a statement of non-assessment tax-waiver. Louis County Circuit Court 7900 Carondelet in Clayton Monday through Friday 800 am to 500 pm.

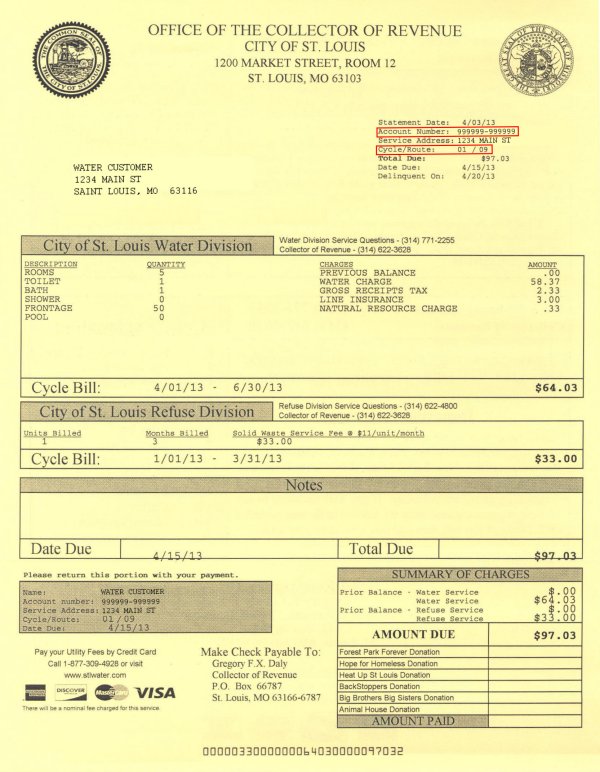

Obtain a Real Estate Tax Receipt Instructions for how to find City of St. Begin online Call 314 622-4171. You may pay personal and real estate taxes with one check but make sure to add them correctly and send the exact amount due.

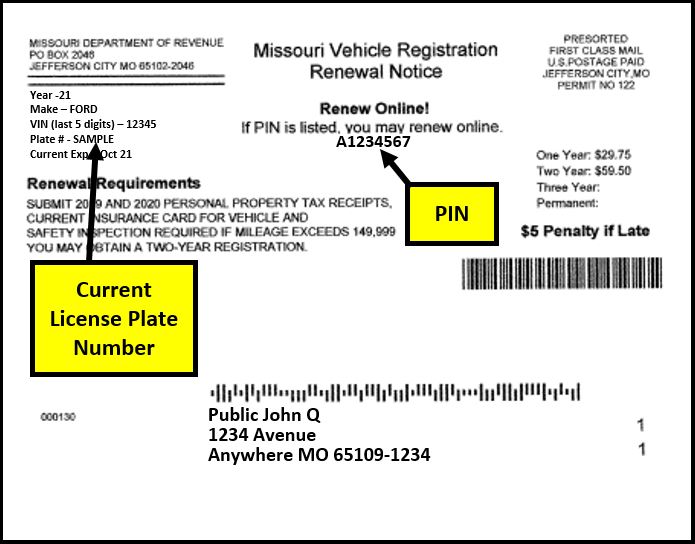

Your Account Number and PIN can be found on the notice you received from the St. Louis City in which the property is located and taxes paid. Account Number number 700280.

Please be sure that your payment is postmarked no late than December 31. For information call 314-615-8091. Simply begin by writing in your name or another persons name and get brisk results.

May 15th - 1st Half Real Estate and Personal Property Taxes are due. Begin to declare your personal property using the Begin Online button and enter. Louis County Online Property Taxes Info From 2021.

Daly Collector of Revenue 1200. You may click on this collectors link to access their contact information. Louis County Parks Cultural Sites Manager John Magurany talks about the rich colonial history youll find in.

Louis City Assessors office. Online tax receipt can be used at the Missouri Department of Revenue license offices when licensing your vehicle. Louis County Missouri - St.

You may be entitled to a personal property tax waiver if you were not required to pay personal property taxes in the previous years. The Begin Online buttons becomes visible in January when the declarations are mailed. Use your account number and access code located on your assessment form and follow the prompts.

How do I pay my personal property tax in St Louis County. Collector - Real Estate Tax Department. Obtaining a property tax receipt.

Tour Colonial History at the Daniel Bissel House. August 31st - 1st Half Manufactured Home Taxes are due. The Collectors office cannot accept payments for the wrong amount.

Ad Find Anyones Personal Property Records.

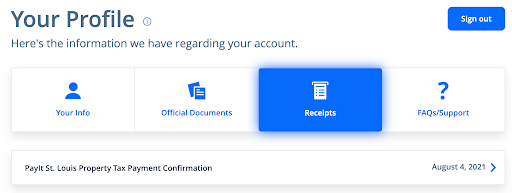

How To Find A St Louis City Personal Property Tax Receipt Online Payitst Louis

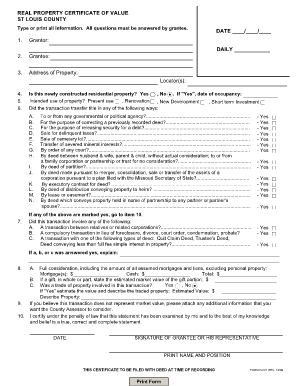

St Louis County Certificate Of Value Fill Online Printable Fillable Blank Pdffiller

Filing Your St Louis County Personal Property Tax Declaration Robergtaxsolutions Com

Collector Of Revenue St Louis County Website

Personal Property Declaration St Louis County Fill And Sign Printable Template Online Us Legal Forms

St Louis County Property Tax Deadline

Print Your St Louis Parking Meter Receipt Free Self Help Legal Information For Missouri Residents

Collector Of Revenue Faqs St Louis County Website

Print Tax Receipts St Louis County Website

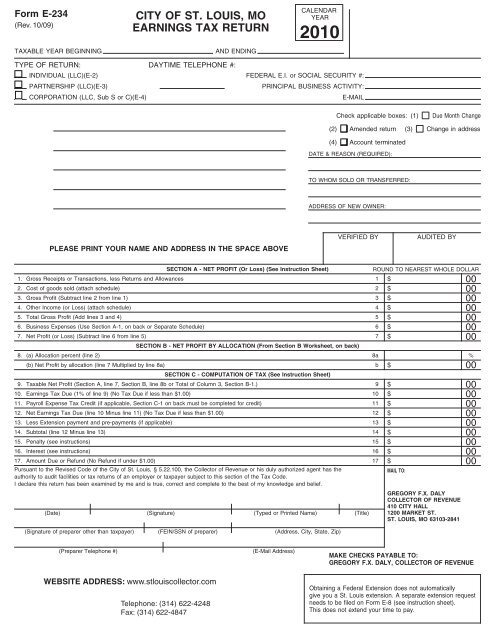

City Of St Louis Mo Earnings Tax Return

Why St Louis County Business Owners Aren T Getting A Tax Break This Year Youtube

Sales Use Tax Credit Inquiry Instructions

St Louis County Personal Property Declaration 2022 Fill Online Printable Fillable Blank Pdffiller